Elevating benchmarks to drive positive returns

The importance of robust sustainable investment monitoring practices

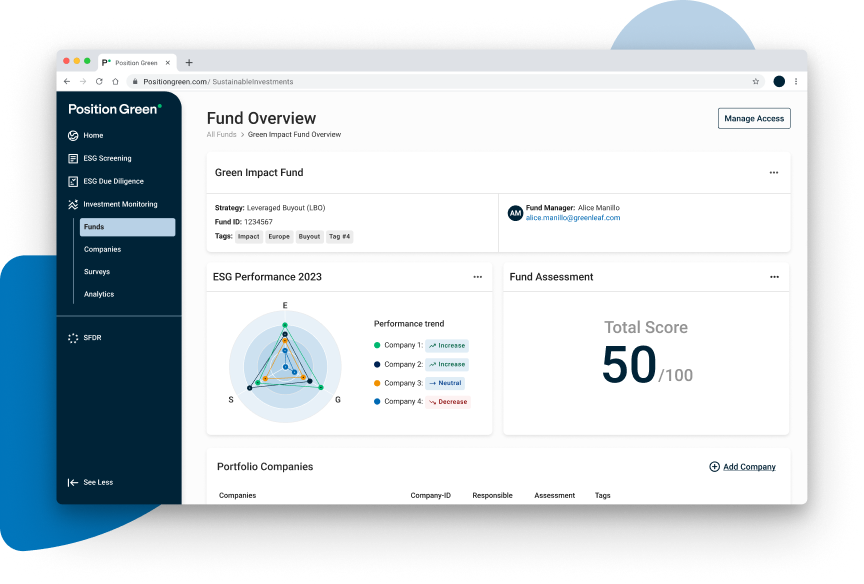

Effective monitoring of sustainable investments involves the continuous evaluation of ESG performance throughout the investment lifecycle. This practice ensures that investments are aligned with sustainability goals and regulatory requirements, enabling investors to identify trends, manage risks, and optimize portfolio value. Given the increasing demand from LPs for sustainable products and ever-expanding ESG regulations, robust monitoring practices are essential for maintaining transparency and accountability.

Why thorough ESG evaluations matter for investors

ESG due diligence is a multifaceted process crucial for identifying, assessing, and mitigating ESG risks and opportunities. This process is not merely a checkbox exercise but a comprehensive evaluation that informs investment strategies and ensures alignment with sustainability goals.

- Advanced data collection and validation: Collecting high-quality ESG data is foundational to due diligence. Effective ESG software should streamline this process, allowing for the integration of data from various sources, such as surveys, third-party reports, and direct stakeholder engagement. The accuracy and granularity of this data enable investors to make informed decisions and develop targeted ESG action plans.

- Systematic risk assessment: Utilizing robust risk assessment frameworks allows investors to systematically identify and evaluate ESG risks. These frameworks help in understanding the potential impact of ESG factors on investments and developing mitigation strategies. By embedding these assessments into the due diligence process, investors can proactively manage ESG risks and leverage opportunities for value creation.

- Continuous monitoring and stakeholder engagement: Post-investment, continuous monitoring ensures that ESG objectives are met and compliance with evolving regulations is maintained. Engaging with stakeholders, including employees, customers, and communities, provides ongoing insights into ESG performance and areas for improvement. This engagement is crucial for aligning ESG initiatives with real-world conditions and expectations.

Benchmarking ESG performance for investment success

Benchmarking allows investors to compare their portfolio companies’ ESG performance against industry standards and peers. This process requires comprehensive and high-quality data to identify areas for improvement, set realistic goals, and drive sustainable growth. Effective benchmarking provides a quantitative basis for assessing how well portfolio companies meet ESG standards and highlights specific areas that require attention.

Leveraging metrics for ESG benchmarking

Reliable and relevant metrics are essential for effective ESG benchmarking. These metrics provide a quantitative foundation for assessing ESG performance, enabling investors to understand how their portfolio companies perform in key areas and identify improvement opportunities. Metrics-driven insights support data-driven decision-making, fostering continuous improvement and alignment with sustainability objectives.

Announcing Position Green’s benchmarking tool

Position Green’s benchmarking feature is a game-changer for private equity sustainability professionals seeking to benchmark their ESG efforts and make informed, strategic decisions. The SI Investment Monitoring software will include one of Europe’s Largest Private Market ESG Dataset. This comprehensive ESG dataset includes information on over 3,500 portfolio companies and 16 new metrics across various sectors, specifically designed to streamline ESG reporting and performance analysis for portfolio companies.

Key features:

![📊]() Comprehensive data charts: An intuitive dashboard to effortlessly compare your portfolio against industry benchmarks.

Comprehensive data charts: An intuitive dashboard to effortlessly compare your portfolio against industry benchmarks.![🔍]() Customizable analysis: Filters allow for tailored analysis, providing insights specific to your investment needs.

Customizable analysis: Filters allow for tailored analysis, providing insights specific to your investment needs.![📅]() Yearly analysis: Detailed yearly analysis, with data updated on an annual basis to ensure you always have the latest information.

Yearly analysis: Detailed yearly analysis, with data updated on an annual basis to ensure you always have the latest information.![🔒]() Fully anonymous: All data remains confidential, allowing for safe and secure analysis.

Fully anonymous: All data remains confidential, allowing for safe and secure analysis.![🔗]() Data sharing model: The “You get what you share” model enriches the dataset, enhancing decision-making capabilities.

Data sharing model: The “You get what you share” model enriches the dataset, enhancing decision-making capabilities.

For more information, visit our Sustainable Investments page.

Stay up to date with the latest ESG-trends with our newsletter

The post Mastering ESG due diligence for sustainable investments appeared first on Position Green.

Comprehensive data charts: An intuitive dashboard to effortlessly compare your portfolio against industry benchmarks.

Comprehensive data charts: An intuitive dashboard to effortlessly compare your portfolio against industry benchmarks. Customizable analysis: Filters allow for tailored analysis, providing insights specific to your investment needs.

Customizable analysis: Filters allow for tailored analysis, providing insights specific to your investment needs. Yearly analysis: Detailed yearly analysis, with data updated on an annual basis to ensure you always have the latest information.

Yearly analysis: Detailed yearly analysis, with data updated on an annual basis to ensure you always have the latest information. Fully anonymous: All data remains confidential, allowing for safe and secure analysis.

Fully anonymous: All data remains confidential, allowing for safe and secure analysis. Data sharing model: The “You get what you share” model enriches the dataset, enhancing decision-making capabilities.

Data sharing model: The “You get what you share” model enriches the dataset, enhancing decision-making capabilities.